Welcome To The MyFinMate AI

AI Driven Financial Management Application

Read More

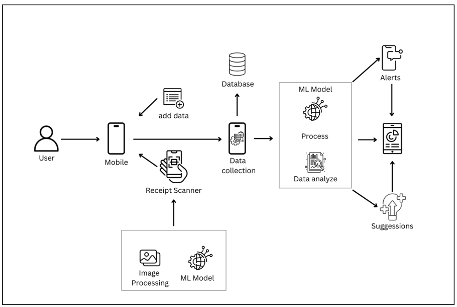

The MyFinMate AI is a project designed to simplify and enhance personal financial management. Using artificial intelligence, it helps users with financial planning, investment management, debt management, and savings management. By providing predictive analytics, and personalized recommendations, this system empowers users to make smarter financial decisions and achieve their financial goals effectively.

The Financial Planning and Analysis (FPA) component is the backbone of the AI Financial Management System, providing users with a comprehensive understanding of their financial situation and offering actionable insights to achieve their financial goals.

The main goal of this component is to assist the users in making better investment decisions and also in enhancing their investment portfolios. Using Artificial Intelligence and data analytics, this component provides a full set of capabilities to assist users cope with the complexity of investment planning and management.

The main goal of this component is to assist users in making necessary decisions whether they have taken loans, or are taking loans unnecessarily, or to pay off the loans taken. It is here to assist users to successfully manage loan payments easily by managing loans using artificial intelligence.

AI-based financial management applications for savings management help users effectively manage their finances, optimize savings, and achieve financial savings goals using advanced artificial intelligence techniques.

The proposed AI-Based financial management system consists of 4 main components. They are;

Android Studio

Jupyter Notebook

VS Code

GitHub

Flutter

Flask

FastAPI

April 2025

50% progress presentation of the research project.

Marks Allocated : 15%

September 2025

90% progress presentation of the research project.

Marks Allocated : 18%

Senior Professor

Pradeep.a@sliit.lk

FACULTY OF COMPUTING | INFORMATION TECHNOLOGY

Assistant Professor

sanvitha.k@sliit.lk

FACULTY OF COMPUTING | INFORMATION TECHNOLOGY

IT20272654

it20272654@my.sliit.lk

FACULTY OF COMPUTING | INFORMATION TECHNOLOGY

IT21286964

it21286964@my.sliit.lk

FACULTY OF COMPUTING | INFORMATION TECHNOLOGY

IT21138218

it21138218@my.sliit.lk

FACULTY OF COMPUTING | INFORMATION TECHNOLOGY

IT21049736

it21049736@my.sliit.lk

FACULTY OF COMPUTING | INFORMATION TECHNOLOGY

Loading map...

SLIIT Malabe Campus, New Kandy Rd, Malabe, Sri Lanka

myfinmateai@gmail.com